The Client’s Story

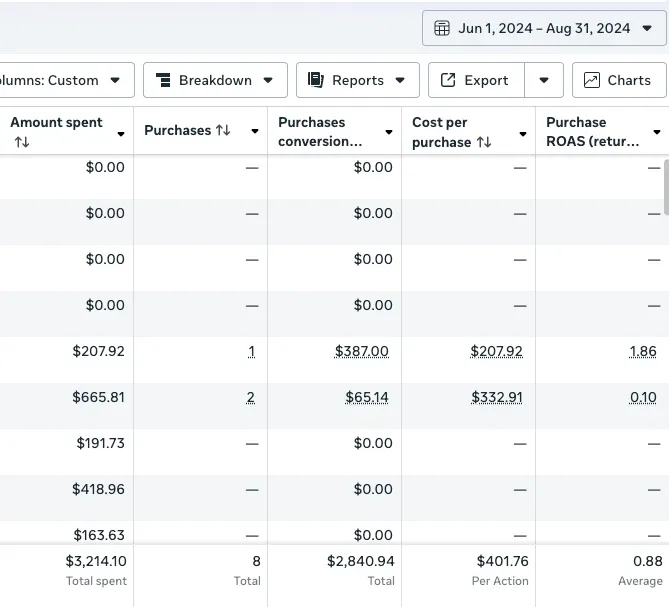

This U.S.-based ecommerce brand offers a curated collection of fine jewelry designed to blend timeless elegance with everyday wearability. With a focus on craftsmanship, their pieces range from delicate necklaces and statement earrings to versatile sets and gift-ready collections. The brand combines fast shipping, accessible pricing, and detailed product presentation to turn browsing into loyal purchasing.

Objectives

Our Shopify marketing agency was brought in to relaunch and optimize paid advertising across Google Ads and Meta Ads. Previous campaigns were running but lacked structure and strategy. The mission was simple: stop budget waste, reach break-even ROAS, and build a scalable acquisition system centered around top-performing products.

Challenge

When we first reviewed the account, nearly all of the ad budget (over 80 percent) was going to inexpensive replacement parts. These products had low AOV, thin margins, and little to no chance of scaling profitably. On Meta Ads, the account relied on static catalog creatives with no real targeting or funnel structure in place. The Google Merchant Center feed was no better, with weak titles, missing attributes, and poor keyword alignment, which negatively impacted both visibility and conversion rates.

Jewelry is also a category that rarely converts on the first click. Customers often need several interactions with a brand before they feel confident making a purchase. Yet there was no multi-touch funnel in place to support this behavior. Retargeting wasn’t active, and top-of-funnel campaigns lacked creative variety or purpose. The system was technically running, but it lacked a genuine growth mechanism.

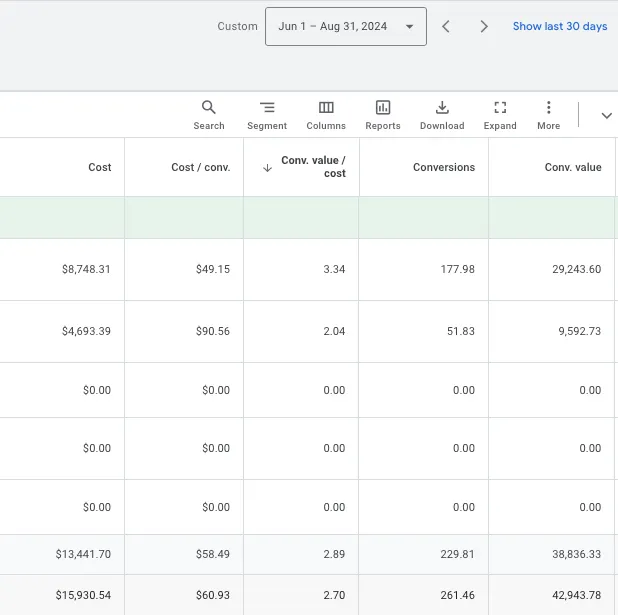

Before: Google Ads & Meta Ads Performance

The Growth Method

Google Ads

- Removed low-value items like replacement parts from the product feed

- Optimized the Merchant Center feed with keyword-focused titles and structured attributes

- Built a diversified campaign system with five core approaches:

- Performance Max focused on bestsellers

- PMax campaigns grouped by top collections

- A broad Shopping campaign to surface new opportunities

- Dedicated campaigns for earrings and necklaces using the top SKUs in each

- Introduced manual CPC bidding to lower costs and regain budget control

Meta Ads

- Created a full-funnel structure from scratch: top, middle, and bottom of the funnel

- Tested creatives by product category, then introduced a winning format that grouped all bestsellers into one ad

- Developed retargeting flows based on engagement depth and cart behavior

- Produced UGC and motion creatives with strong angles around gifting, product storytelling, and social proof

Early Wins

Within the first few weeks, the budget stopped flowing into low-margin parts. That alone lifted the efficiency of both platforms. On Meta, the all-in-one bestseller ad delivered twice the clickthrough rate of any category-based creative. Google’s CPC dropped steadily, helped by both feed optimization and tighter manual bidding. Retargeting finally kicked in on Meta, and we began recovering the high-intent traffic that had previously bounced without converting.

What Blocked Growth

Even with a strong foundation, growth wasn’t frictionless:

- Jewelry requires longer decision cycles, making short attribution windows less reliable

- Meta Ads attribution remained inconsistent across channels

- Scaling beyond top sellers proved difficult, as mid-tier SKUs converted less efficiently

How We Fixed It

We doubled down on what was working. Scaling remained focused on proven bestsellers, but we also laid the groundwork for growth by planning CRO improvements and offering tests for the underperforming SKUs. Attribution windows were extended and cross-checked using Shopify and TripleWhale, providing us with more accurate readings on actual performance.

We also introduced product bundles, pairing earrings and necklaces together to increase AOV while still relying on proven creatives and high-converting product pages. This allowed us to generate incremental revenue without creating unnecessary complexity.

Scaling Strategy

- On Google Ads, scaled earrings and necklaces separately using Performance Max with custom signals

- On Meta Ads, expanded winning creatives using a variation loop — new hooks and UGC launched every two weeks

- Increased ad spend gradually in 10 to 20 percent increments while monitoring ROAS and conversion metrics

- Shared high-performing SKUs between platforms to fuel creative iterations and product prioritization

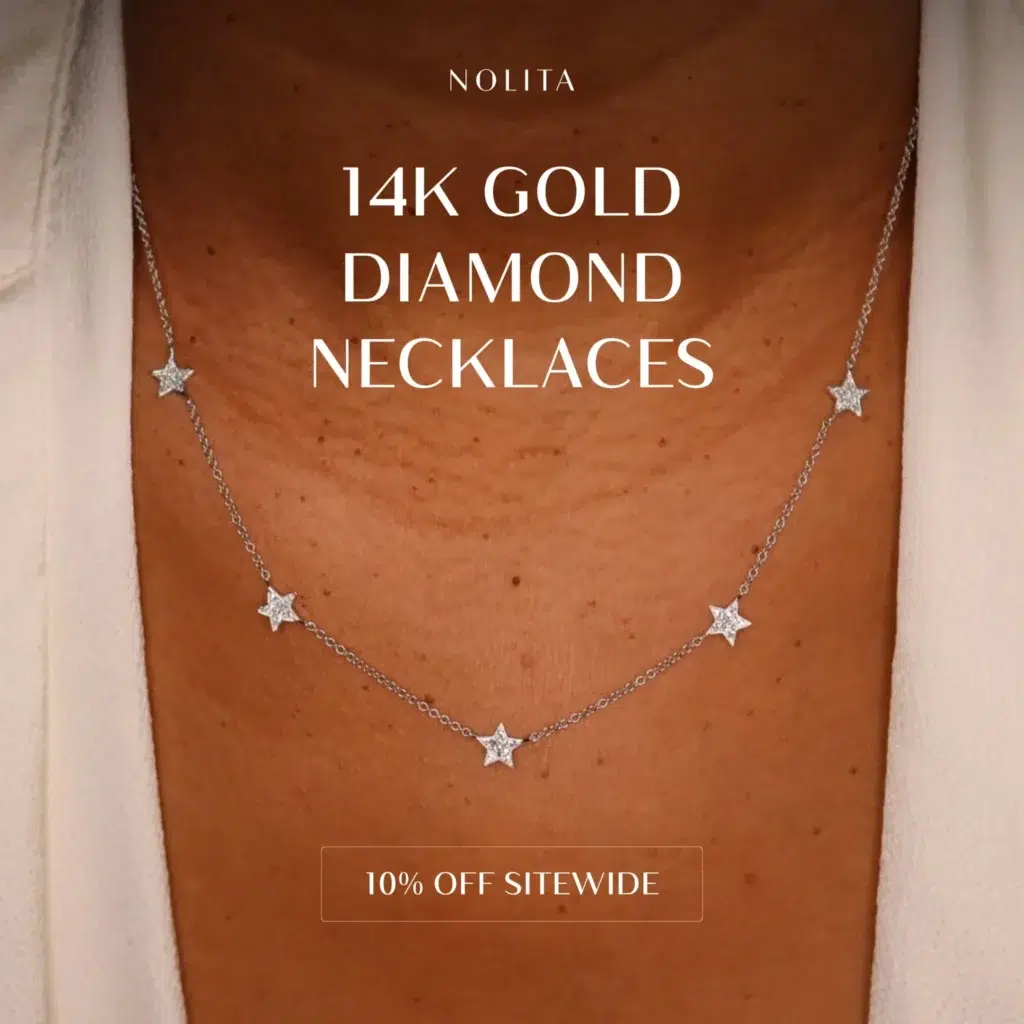

Performance Snapshot

The most significant lift came from eliminating waste, isolating what works, and scaling with control. The foundation was strong enough to support long-term growth, not just a quick spike in performance.

Google Ads

Revenue: $114,149.01

Spend: $35,463.69

ROAS: 3.2 (previously estimated at 2.7)

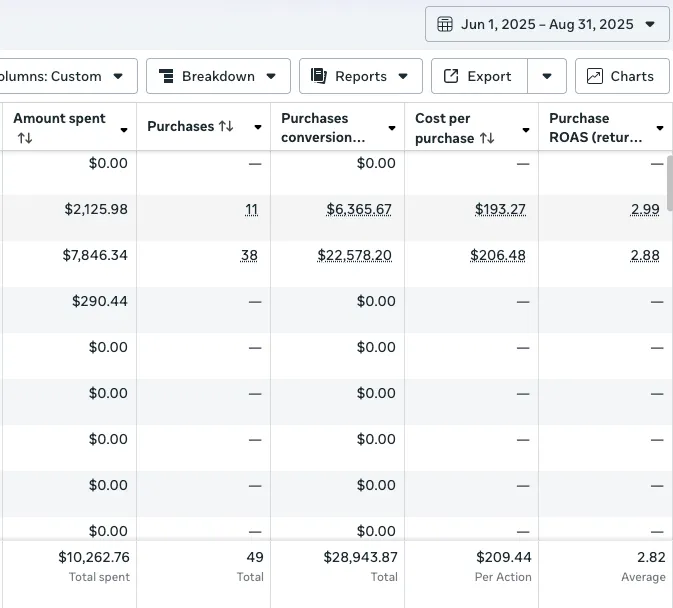

Meta Ads

Revenue: $28,943.87

Spend: $10,262.76

ROAS: 2.8 (previously estimated at 0.9)

After: Google Ads & Meta Ads Performance

What’s Next

The next step is unlocking growth beyond bestsellers. We’re building dedicated landing pages to support mid-tier products and applying CRO improvements based on behavior data from the first 30 days. Product bundling will be expanded further, particularly around gift-giving occasions such as anniversaries or seasonal campaigns.

We’ll also begin testing dynamic product ads that go beyond simple catalogs, using motion and storytelling to re-engage shoppers. Once domestic scaling holds steady, international expansion into the UK and EU is already on the roadmap.