The Client’s Story

A U.S.-based e-scooter brand selling high-ticket products direct-to-consumer. After a few early wins with paid ads, they hit a ceiling. ROAS was decent, but revenue growth had plateaued. They needed a performance partner to unlock the next level.

Objectives

The client approached our Shopify marketing agency with a clear objective: relaunch and optimize their paid advertising efforts across Meta and Google to increase revenue, improve efficiency, and maximize ROAS. They had run campaigns before but struggled to make them profitable, and needed a structured performance strategy to scale effectively.

Challenge

Previous ad campaigns were underperforming due to scattered account structure, lack of performance-focused creative, and incomplete tracking setups. Both Google and Meta ads showed poor ROAS, and key signals like purchase events and pixel data were missing or unreliable — limiting optimization potential and learnings.

The Growth Method

Creative & Landing Page Overhaul

- Developed new landing pages with client input to improve conversion rates.

- Created refurbished model campaigns and promoted new arrivals.

- Launched video ads and tested YouTube thumbnail-style campaigns to engage prospects.

Audience Segmentation & Targeting

- Segmented audiences by location, language, and demographics:

- Local LA campaigns

- Mexican-speaking audiences

- Student segment targeting

- Implemented audience exclusions to focus spend on new high-intent customers.

Product & Campaign Optimization

- Optimized Google Ads product feed for relevance.

- Refined Meta Ads creative strategy using a proprietary creative analysis system to multiply success.

- Fixed tracking issues and implemented TripleWhale analytics for better campaign insights.

Testing & Experimentation

- Ran test campaigns alongside existing stable campaigns.

- Iterated creatives based on data-driven insights from TripleWhale and Adveronix automation.

Early Wins

- Enhanced portfolio of tests: Video ads, YT campaigns, and newly segmented audiences outperformed older campaigns.

- Improved ROAS: Significant lift on both platforms, demonstrating the impact of better creative variety and targeting.

- Better analytics: Tracking micro-conversions allowed Google and Meta algorithms to optimize more effectively.

What Blocked Growth

As we began scaling, new limitations emerged. Meta’s learning phase was often interrupted due to budget shifts, while Google’s Performance Max campaigns showed uneven performance across asset groups. On both platforms, creative fatigue began to show — especially in prospecting.

How We Fixed It

We implemented stricter budget rules to preserve campaign learning and ran creative sprints to refresh top-performing formats. On Google, we broke out asset groups by theme and applied negative keyword sculpting to eliminate irrelevant queries. Cross-platform tracking was improved using server-side integrations and GA4 event auditing.

Scaling Strategy

- Vertical & horizontal scaling: Increased budget on top-performing campaigns while launching new test campaigns.

- Audience expansion: Targeted new segments without cannibalizing existing profitable campaigns.

- Creative iteration: Continuously tested ad variations to find winning combinations.

- Budget optimization: Focused on high-performing campaigns while excluding low-efficiency audiences.

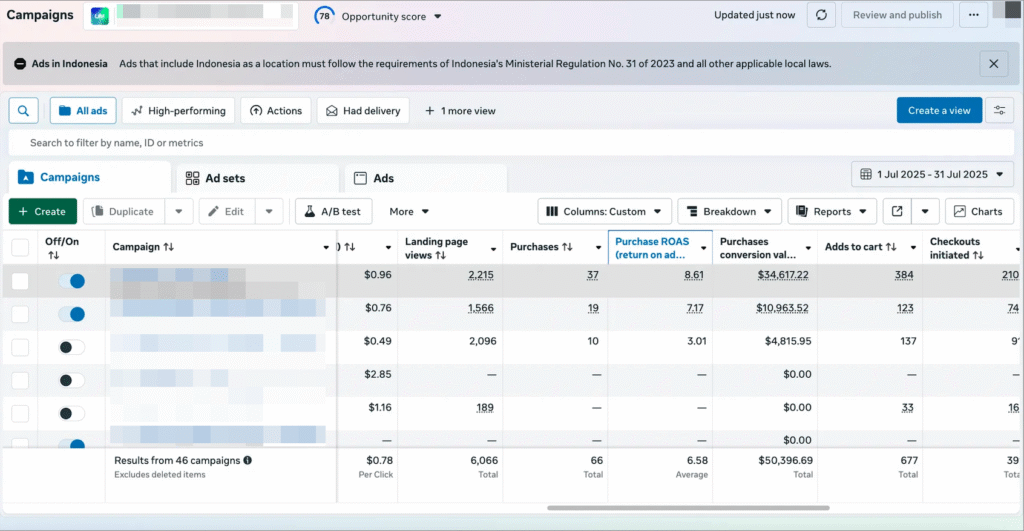

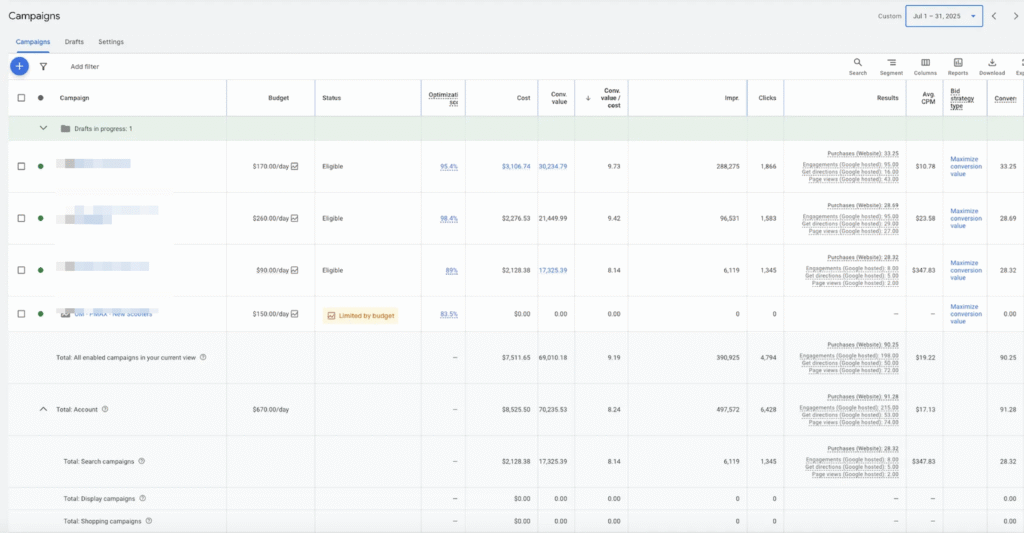

Performance Snapshot

The brand achieved a stable 3.3x blended ROAS across Meta and Google, with 40% higher average daily revenue compared to previous months. CAC dropped by 28%, while shopping ad CTRs improved by 47%. The store maintained a healthy conversion rate despite increased traffic and higher spend.

- Meta Ads ROAS: 6.58

- Google Ads ROAS: 9.19

This ecommerce case study proves that with the proper structure, Shopify brands can scale profitably through Google Ads and Meta Ads.

Meta Ads Performance

Google Ads Performance

What’s Next

We’re currently testing bundled product offers and financing-based hooks in ad creative. In addition, we’re building a retention engine with email and SMS flows to extend LTV and reduce dependency on paid media. Expansion into additional U.S. states and selected EU markets is in the pipeline.